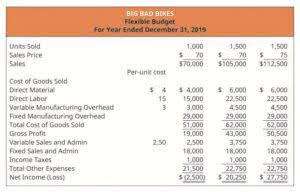

The second way could be to adjust purchases and sales of inventory in the inventory ledger itself. The problem with this method is the need to measure value of sales every time a sale takes place (e.g. using FIFO, LIFO or AVCO methods). If accounting for sales and purchase is kept separate from accounting for inventory, the measurement of inventory need only be calculated once at the period end. This is a more practical and efficient approach to the accounting for inventory which is why it is the most common approach adopted. In sum, using the LIFO method generally results in a higher cost of goods sold and smaller net profit on the balance sheet. When all of the units in goods available are sold, the total cost of goods sold is the same, using any inventory valuation method.

How the FIFO inventory valuation method works

Ecommerce merchants can now leverage ShipBob’s WMS (the same one that powers ShipBob’s global fulfillment network) to streamline in-house inventory management and fulfillment. With this level of visibility, you can optimize inventory levels to keep carrying costs at a minimum while avoiding stockouts. ShipBob’s ecommerce https://x.com/BooksTimeInc fulfillment solutions are designed to make inventory management easier for fast-growing DTC and B2B brands. Suppose a coffee mug brand buys 100 mugs from their supplier for $5 apiece. A few weeks later, they buy a second batch of 100 mugs, this time for $8 apiece. To calculate the value of ending inventory, a brand uses the cost of goods sold (COGS) of the oldest inventory, despite any recent changes in costs.

Using FIFO for inventory valuation

Every time a sale or purchase occurs, they are recorded in their respective ledger accounts. https://www.bookstime.com/ However, as we shall see in following sections, inventory is accounted for separately from purchases and sales through a single adjustment at the year end. There are three other valuation methods that small businesses typically use. Some companies choose the LIFO method because the lower net income typically leads to lower income taxes.

First-In First-Out (FIFO Method)

Learn more about the difference between FIFO vs LIFO inventory valuation methods. This method dictates that the last item purchased or acquired is the first item out. This results in deflated net income costs and lower ending balances in inventory in inflationary economies compared to FIFO. The company’s accounts will better reflect the value of current inventory because the unsold products are also the newest ones. Assume a company purchased 100 items for $10 each and then purchased 100 more items for $15 each. The COGS for each of the 60 items is $10/unit under the FIFO method because the first goods purchased are the first goods sold.

With real-time, location-specific inventory visibility, intelligent cycle counts, and built-in checks and balances, your team can improve inventory accuracy without sacrificing operational efficiency. For example, say that a trampoline company purchases 100 trampolines from a supplier for $40 apiece, and later purchases a second batch of 150 trampolines for $50 apiece. It’s important to note that the FIFO method is designed for inventory accounting purposes. In many cases, the inventory that’s received first isn’t always necessarily sold and fulfilled first. Read on for a deeper dive on how FIFO works, how to calculate it, some examples, and additional information on how to choose the right inventory valuation strategy for your business.

- The remaining unsold 675 sunglasses will be accounted for in “inventory”.

- While the LIFO inventory valuation method is accepted in the United States, it is considered controversial and prohibited by the International Financial Reporting Standards (IFRS).

- We will then have to value 20 units of ending inventory on $4 per unit (most recent purchase cost) and the remaining 3 units on the cost of the second most recent purchase (i.e., $5 per unit).

- Extensiv also enables real-time visibility into inventory levels and product aging, facilitating FIFO adoption.

- We’ll also compare the FIFO and LIFO methods to help you choose the right fit for your small business.

- However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period.

Improve Inventory Management with FreshBooks

This is especially important when inflation is increasing because the most recent inventory would likely cost more than the older inventory. First-in, first-out (FIFO) is one of the methods we how to do fifo can use to place a value on the ending inventory and the cost of inventory sold. If we apply the FIFO method in the above example, we will assume that the calculator unit that is first acquired (first-in) by the business for $3 will be issued first (first-out) to its customers.

It is the amount by which a company’s taxable income has been deferred by using the LIFO method. The FIFO (“First-In, First-Out”) method means that the cost of a company’s oldest inventory is used in the COGS (Cost of Goods Sold) calculation. LIFO (“Last-In, First-Out”) means that the cost of a company’s most recent inventory is used instead. On the basis of FIFO, we have assumed that the guitar purchased in January was sold first. The remaining two guitars acquired in February and March are assumed to be unsold.

FAQs About FIFO Method

- It’s also highly intuitive—companies generally want to move old inventory first, so FIFO ensures that inventory valuation reflects the real flow of inventory.

- For example, FIFO can cause major accounting discrepancies when COGS increases significantly.

- To calculate her COGS for the trade show, Bertie will count 100 bars at $2.00 and 200 at $1.50.

- In our bakery example, the average cost for inventory would be $1.125 per unit, calculated as (200 x $1) + (200 x $1.25)/400.

- Keep your accounting simple by using the FIFO method of accounting, and discuss your company’s regulatory and tax issues with a CPA.

- You should also know that Generally Accepted Accounting Principles (GAAP) allow businesses to use FIFO or LIFO methods.

The company then applies first-in, first-out (FIFO) method to compute the cost of ending inventory. The calculation of inventory cost is an important part of filing your business tax return. Like other legitimate business costs, the cost of the products you buy to resell can be deducted from your business income to reduce your taxes. One reason for valuing inventory is to determine its value for inventory financing purposes. Another reason for valuing inventory is that inventory costs are included in the cost of goods sold, which reduces business income for tax purposes. By giving priority to remaining inventory, you can more effectively manage the risk of perishable goods expiring or outdated products becoming obsolete.

Understanding Just in Case Inventory: A Comprehensive Guide for Ecommerce Businesses

FIFO serves as both an accurate and easy way of calculating ending inventory value as well as a proper way to manage your inventory to save money and benefit your customers. Three units costing $5 each were purchased earlier, so we need to remove them from the inventory balance first, whereas the remaining seven units are assigned the cost of $4 each. On the third day, we assign the cost of the three units sold as $5 each. This is because even though we acquired 30 units at the cost of $4 each the same day, we have assumed that the sales have been made from the inventory units that were acquired earlier for $5 each.